The Secret to Stress-Free Events for Business Owners

Posted: December 4, 2023

As a business owner, planning and hosting events for your employees, clients, or customers can be a great way to build relationships and boost morale. However, organizing a successful event can be a daunting task. To make the process smoother and ensure a stress-free experience, consider these valuable tips: 1. Set Clear Objectives Begin by defining the purpose and objectives of your event. What do...

How to Turn Small Business Saturday into Big Opportunities

Posted: November 19, 2023

Small Business Saturday is just around the corner, and it’s the perfect time to celebrate and support local businesses. This annual event, which falls on the Saturday after Thanksgiving, encourages consumers to shop locally and discover the unique offerings of small businesses in their communities. As we approach this special day dedicated to small enterprises, we also want to help you seize the opportunities the...

10 Tips & Tools to Help Your Veteran-Owned Business Succeed

Posted: November 4, 2023

As we approach Veterans Day, we want to take a moment to express our deepest gratitude to all veterans for their unwavering dedication and service to our nation. In honor of your sacrifices and commitment, here are ten ways to ensure your business’s success and safeguard your hard-earned progress. 1. Get Support Through the Office of Veterans Business Development (OVBD). Start by tapping into the...

9 Habits of a Strong Female Leader

Posted: October 19, 2023

National Business Women’s Week is celebrated during the third week in October every year. This gives us an opportunity to recognize and honor working women. For nearly a century, this celebration has helped promote leadership roles for women. Trading old habits for better ones can help women become more effective leaders in their organizations. Here are nine habits of strong female leaders. Step Out of...

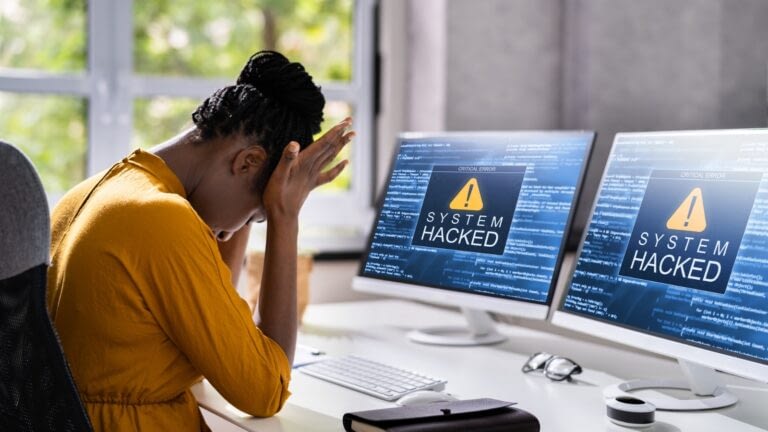

Is My Small Business Vulnerable to Cyber Attacks?

Posted: October 4, 2023

October is National Cyber Security Awareness Month. With the increasing prevalence of cybercrime in small businesses, it is crucial to be aware of the risks and take the necessary actions. The following statistics were reported by Small Biz Trends: Nearly 43% of cyber attacks target small and medium-sized businesses. Only 14% of targeted small businesses are prepared to handle cyber attacks. Costs of cybercrime are...